s corp dividend tax calculator

If an S corp allocates 125000 profit to you the shareholder the character of such income is important. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the.

S Corporation Income Tax Calculator S Corp Calculator

An S corporation is not subject to corporate tax.

. 3375 of Dividend Income for income within. 875 of Dividend Income for income within the Basic Rate band of 20. Dividends are paid by C corporations after net income is calculated and taxed.

The Main Differences With A C-Corp. To use the table above all you need to know is your filing status and total income for the year. If an S corporation shareholder receives.

Call HMRC on 0300 200 3300 so they can change your tax code. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare. Before using the calculator you will need to.

S corp shareholder distributions are the earnings by S corporations that are paid out or passed through as dividends to shareholders and only taxed at the shareholder level. Distributions from S corporation earnings are identical to the rules governing partnership distributions. Our calculator will estimate whether electing S corp will result in a tax win for your business.

The leftover funds are distributed as. S corp qualified dividends usually refer to the dividends paid out of earnings accumulated during the tax years when an S corporation operated as a C corporation. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

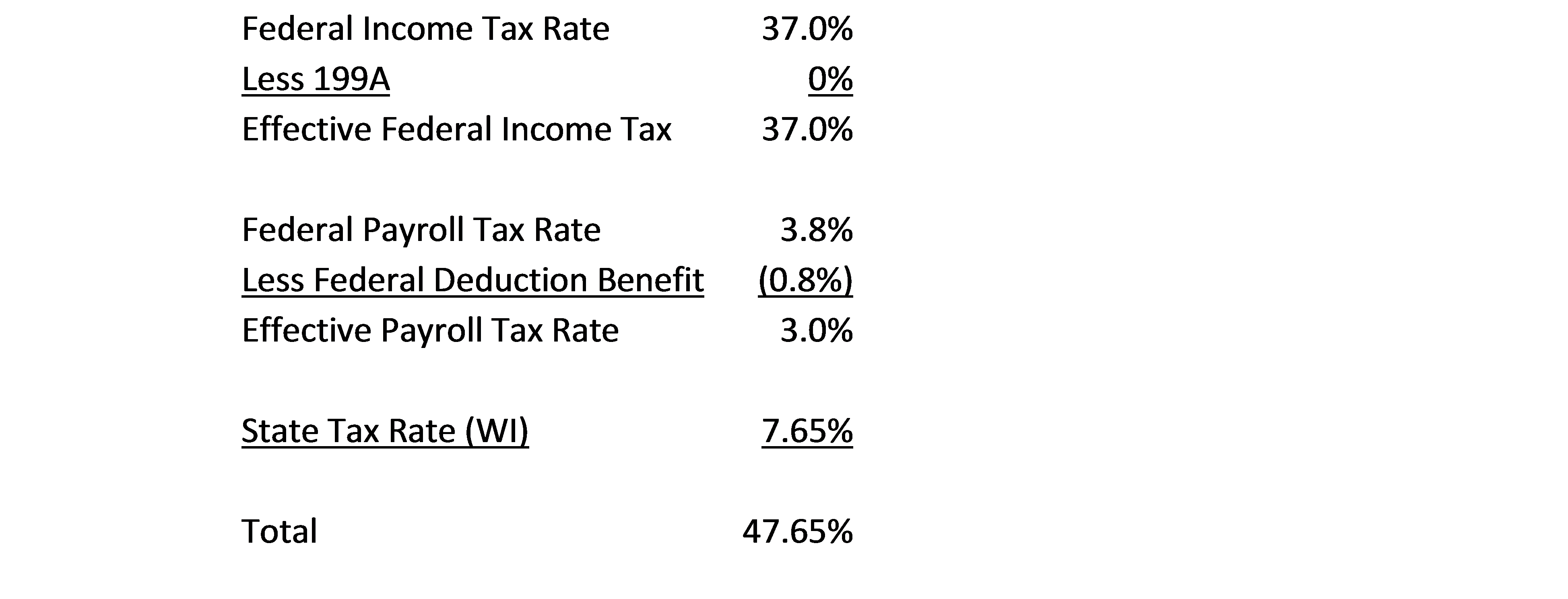

If you earn 100000 or. As of this writing the corporate income tax rate is 21 meaning your net business income will be taxed at that rate and not at an individual tax rate. Taxes must be paid on income when it is earned regardless of.

The dividend tax rates for dividends that exceed the set allowance are. You pay 75 on the next 1000. Just complete the fields below with your best estimates and then register to get your CPA or schedule a free Consultation here 1 Select.

Electing S corp status allows LLC owners to be taxed as employees of the business. If you have a high income you may pay a 20 dividend tax and the 38 net investment income tax also known as the Obamacare tax Exception 2. You dont pay any dividend tax on the first 2000 you make in dividends.

875 basic 3375 higher and 3935 additional. S corp dividend tax calculator Tuesday March 1 2022 Edit. This calculator has been updated for the 2022-23 tax year.

Determine a reasonable salary for the. Any remaining business profits are distributed to owners as dividends. See the table below.

But as an S corporation you would only owe self-employment tax on the 60000 in. If income is standard income you would pay the standard income tax rates. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

The new dividend tax rates for 202223 tax year factoring in the 125 point rise are. So lets say youre single and have 150000 of annual income with 10000 of that.

S Corp Federal Tax Filing Dates Turbotax Tax Tips Videos

S Corp What Is An S Corporation Subchapter S

How To Convert To An S Corp 4 Easy Steps Taxhub

Federal Income Tax Calculator Atlantic Union Bank

Tax Memo Is Your S Corp Saving You Taxes Or Helping Evade Them Chris Whalen Cpa

Tax Distributions For Pass Through Entity Owners Frost Brown Todd Full Service Law Firm

How An S Corporation Reduces Fica Self Employment Taxes

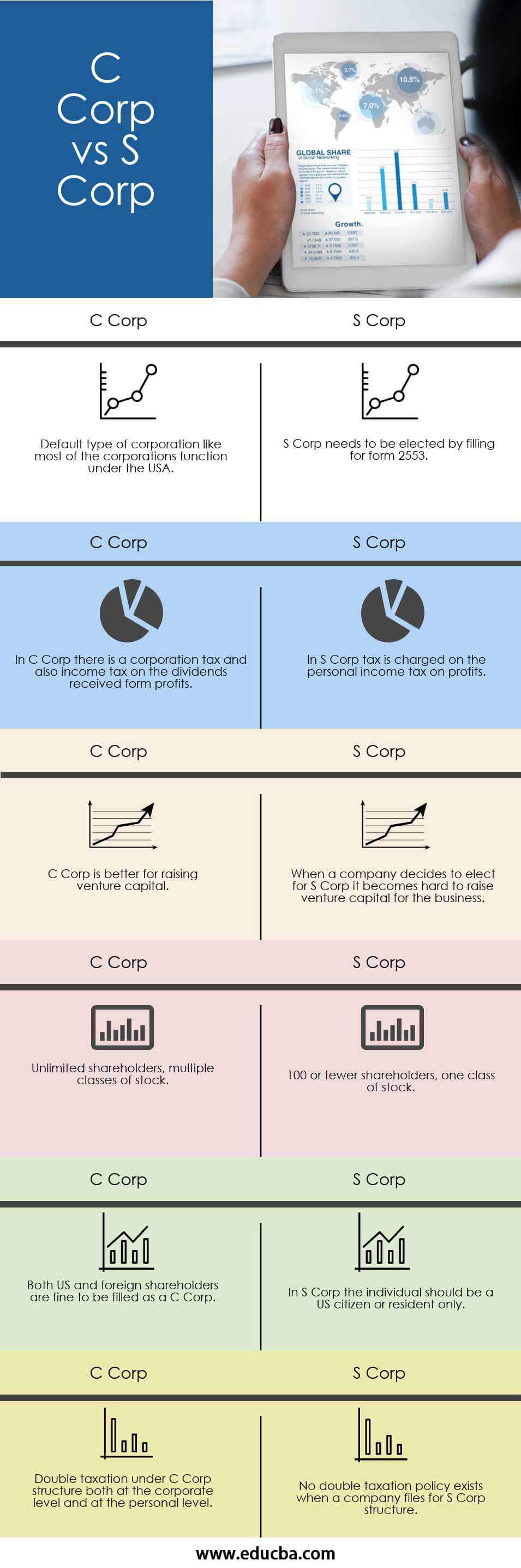

C Corp Vs S Corp Top 6 Best Differences With Infographics

%20Image%20(GD-665).png)

Small Business Tax Calculator Taxfyle

Calculate Your S Corporation Tax Savings Zenbusiness Inc

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

A Beginner S Guide To S Corporation Taxes

Double Taxation Of Corporate Income In The United States And The Oecd

Tax Foundation Needs To Fix Their Map The S Corporation Association

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Simple Tax Refund Calculator Or Determine If You Ll Owe

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Geek Tuesday Determining A Shareholder S Basis In S Corporation Stock And Debt